Filling up

Taking refillable and reusable packaging mainstream

Consumer demand is high concludes a trial for refillable and reusable packaging run by the UK’s Refill Coalition – made up of retailers Aldi UK and Ocado, supply chain solutions company CHEP and GoUnpackaged.

They trialled two new solutions for in-store refill and online returnables in response to the 'over consumption of single-use packaging and its associated waste'.

The Refill Coalition claims that if every household refilled one item a week, 1.4bln single-use packaging items per year would be eliminated.

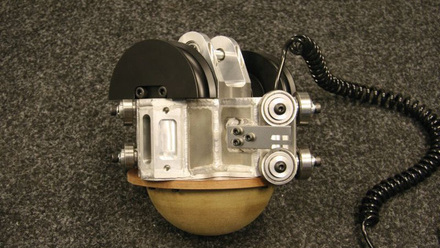

In-store Aldi trialled a reuseable supply chain vessel (equivalent to 24 single-use packs) that was shipped via the normal supply chain, and then fitted into a modular in-store refill fixture from which customers refill their own packaging. Two trials were run over 16 months. The trial range included porridge, granola and various cereals.

While online retailer Ocado trialled a reusable vessel equivalent to five single-use plastics packs. It is pre-filled with product and shipped to customers along with the rest of their Ocado order, and then returned to the Ocado driver when empty. This trial ran out of three customer fulfilment centres covering 65% of its customer base.

A report on the trials entitled Key Learnings for Industry reveals strong consumer demand for both the in-store and online solutions. The sales share for the in-store refills reached a regular 30%, and sometimes up to 56%, compared to single-use packaging alternatives.

'That’s a very high sales share when all you are doing is basically putting the unit in store and there isn’t a wider piece of communication going out to consumers,' noted Helen Clements, Director of Innovation & Behaviour Change Lead at GoUnpackaged, speaking at a recent Refill Coalition webinar.

Online, the reuse products sold at an average 16% sales share, reaching up to 43% some weeks.

Laura Fernandez FIMMM, Senior Packaging Sustainability Manager at Ocado Retail Ltd, speaking at Packaging Innovations & Empack 2025 earlier this year, explained that there were more than 500,000 orders.

Their trial related to rice, pasta, laundry detergent and laundry conditioner because research indicated customers would be most comfortable with these categories, which Fernandez described as highest value and high frequency.

She told the audience, '…transitioning successfully to a reuse scheme is very complex and not something that can be taken light-heartedly', so Ocado conducted market research and internal workshops prior to the trial to understand what customers wanted and any frustrations. 'There’s no point to deliver a great system that we think will work if customers are not going to buy into it.'

Economics, efficiencies and environmental impact

The Refill Coalition concludes that the solutions are driven by viable commercial business cases, including the additional wash and reverse logistics required. They also claim to have proved it is safe and hygienic, meeting retailers’ high food safety standards.

With consumer convenience the name of the game, the in-store solution at Aldi was also found to be simple and efficient, with staff reporting quick and easy replenishment. Around 21% of sales using refillable products were made using customers’ own containers, while 79% made use of a free paper bag at the refill station.

Ocado reports that its target return rate for the vessel in the first six months of the trial period was met, and currently stands at 86% without any financial incentive. Fernandez noted that they discounted applying a deposit on the vessel due to the focus on convenience, so the cost to the customer is exactly the same as single use.

Clements added that 'the customer fulfilment centres reported a very minor impact to their existing operations'.

On comparing the trial to others, Clements said that 'it preserves the goods from the point of supply, the point of manufacture, so your shelf lives are better. Operationally, this works much better, and also it means that there is greater security and greater ability to provide choice through the operation'.

While Fernandez shared that the returnable vessel trialled by Ocado was designed based on customers wanting a mini-bulk format, which they call ‘fugly’ – functionally ugly. 'And it’s on purpose so we can get it back.'

The vessel carries an RFID tag for tracking and a peelable label is designed for easy removal pre-wash. Customers can also scan the 2D QR code to find out why reuse matters.

In-store, there can be multiple sensors distinguishing the premium brand from the value one, meaning 'There’s no opportunity for fraud in the system', shared Clements.

A survey of 600 Aldi customers who used the refill station revealed that 97% found it hygienic, while 89% found it easy to reuse. More than 490 Ocado customers who purchased the returnable products were surveyed and all found the packaging to be clean and the product hygienic, with 96% likely to buy again in the future.

Citing the trials’ popularity, Catherine Conway, Director & Reuse Lead at GoUnpackaged and member of the UK Government’s Circular Economy Taskforce, believes this shows 'that there is this real, latent desire for reuse amongst mainstream customers'.

An independent Life Cycle Assessment, carried out by Eunomia Research & Consulting, compared the reusable vessels with a high density polyethylene (HDPE) plastic bag in a folding boxboard – a bag-in-box – for cereals; unlined kraft paper bag for oats, polypropylene (PP) bottles for laundry liquid and fabric conditioner, HDPE bags for rice and PP plastic bags for pasta (see box-out below).

In the bag?

The UK Refill Coalition has published a report on Key Learnings for Industry based on a Life Cycle Assessment of recent trials involving retailer Aldi in-store and online retailer Ocado.Some of the key findings include:

- Products like granola, muesli and other cereals packaged in single-use bag-in-box formats reported higher environmental impacts than the reusable alternative for all impact categories.

- For products like oats packaged in single-use unlined paper bags, the single-use format performs better than the reusable alternative in four out of seven categories.

- Rice and pasta packaged in a single-use plastic bag and laundry detergent/conditioner in single-use plastic bottle formats reported higher environmental impacts than the reusable alternatives for all impact categories.

The analysis reportedly shows that, at scale, both solutions perform better than single-use alternatives, with seven-out-of-eight products doing better across environmental impact categories. The results demonstrate that the ‘break-even’ points of the vessel are between five and 20 rotations, which is said to be achievable within the projected lifespans.

Simon Hann, Eunomia Managing Consultant, highlighted at a briefing on the trials’ results that the refill option for granola and museli saw a 49% reduction of CO2 emitted per serving, compared to a single-use bag. Compared to a standard cereal box, there is a 57% reduction in CO2.

Oats are the only product that did not prove to be better in terms of sustainability, as the refill option increased CO2 emissions by 26% compared to the unlined paper bag. But Hann points out that if the wash plant was powered by renewable electricity, the 'break-even point [is] fewer than 24 reuses'.

Rice and pasta packaging showed a 45% and 18% reduction in CO2 compared with single-use plastic bags, respectively, with between seven to 14 reuses.

The only liquids in the entire trials were the detergent and conditioner, which both achieved an 83% reduction with a break-even of only two reuses. 'This is a really good example of where this should be rolled out more generally,' noted Hann. 'Any liquids appear to be a bit of a no-brainer for moving towards refill in this instance, because of how efficiently this packaging works compared to the incumbent single-use plastic bottles.'

The manufacturer of both refillable solutions, Berry Global, estimates that each vessel has a lifespan of at least 60 uses, while Clements highlighted that most reusable packaging is generally built to last at least 5-20 times.

She said, 'We think it will be more than that, but as with most things in refill and reuse, there isn’t any data until you collect it and analyse it yourself.'

Rob Spencer, Director at GoUnpackaged, noted at the recent Refill Coalition webinar, 'The paradox with refill in-store is that the shopper feels that products should be cheaper because they’re not paying for packaging. But we know with the manual traditional refill systems, it’s actually more costly to sell products to consumers in that way.' This is why they designed the modular solution with these vessels that are filled at source and move through the supply chain, to strip the extra cost for refill out of the supply chain.

'There’s no reason to think that these products [sold] via refill need to be sold at a premium,' Spencer asserted. Remarking that it actually helps with economising. 'I think in terms of the economic situation and the cost of living. I don’t see that as a wind blowing against the adoption of refill by consumers,' he concluded.

Taking it to the next level?

Good business

A study by GoUnpackaged, part of the UK’s Refill Coalition, reveals how adopting reusable packaging for just 30% of goods in UK grocery retail could deliver substantial financial and environmental rewards.The study reveals that moving to just 30% reuse would deliver:

- A £136mln annual saving for producers in Packaging Extended Producer Responsibility costs, for the products in scope.

- A £314-£577mln annual saving in overall system costs versus single-use, equal to a 12-22% saving.

- A 95% reduction in CO2e emissions, for the products in scope, more than 800,000t saved.

- 95% reduction in packaging materials and waste for the products in scope, saving more than 300,000t of packaging waste per year.

- 13,000 net new jobs.

The report also contains key recommendations for industry and government to work together to co-design a ‘transition plan’ to reach 30% reuse by 2035, coordinating retailers, supply chain logistics, waste management and local authorities.

The Coalition is keen to point out that collaboration among competitors on new reusable packaging solutions would reduce costs and risks for individual businesses.

The in-store trial was unable to be tested at further scale due to a lack of wider engagement within the supply chain, while Ocado says its learnings continue as it scales its reuse offering.

The report on key learnings recommends the following to support scale-up – filling automation and item-level tracking, legislation prioritising reuse as a driver for change, and a renewed focus by UK retailers on refill and reuse.

The Coalition believes that industry scale-up would deliver the volume necessary to decrease the per unit costs of equipment, filling, wash and reverse logistics, so it becomes competitive or, in some cases, more cost-effective than single-use solutions (see box-out opposite).

Stuart Chidley, Co-Founder of Reposit, also spoke at Packaging Innovations & Empack 2025, outlining his organisation’s goal to create a cross-category, returnable packaging platform.

He advised that, 'The more products you offer, the more successful it is, the more standardisation you can drive into the supply chain, just like the [Refill Coalition] project we’ve just heard about. It’s fundamental, because if we’re going to scale a system that costs a lot of money, we need standardisation in that system, rather than duplicating cost.'

He added, 'Nobody is going to invest in that scale-up solution without the data from all the projects that are happening at the moment.'

Ocado is certainly committed to reuse, reported Fernandez. 'We want to extend to all of our customer fulfilment centres…we want to increase the range. What we are trying to do is make reuse the future norm.'

Chidley noted, 'There’s been so many refill and reuse trials that are in the dark, dingy, refill corner of the store. If we want people to adopt reuse instead of single use, we need to disrupt the habitual customer journey.' For example, customers are used to going to the cosmetics aisle for their shampoo, not the dedicated refill/reuse part of the store.

Conway echoed this view, noting that many customers are accustomed to using Ocado’s regular button online, which means reuse options can get lost. But there is an opportunity for design and to create a 'different language' to help consumers change behaviours.

Reposit wants to nudge consumer behaviour by rewarding packaging returns.

The opportunity is there for the taking, shared Conway, as research from Opinion surveyed 2,000 'nationally representative people'. They found that 68% would incorporate reuse and refill into their weekly shop if available, which rises to 77% for 18-34-year-olds.

Conway asserted, 'You’ve also got to think about who your customers of the future are, who are your employees of the future, and they are very highly engaged in reuse…I think the evidence is there. It’s just there’s no access to it, because in the majority of retail outlets, you cannot refill and reuse anything.'

Chidley pointed out that the UK’s Deposit Returns scheme, which launches in October 2027, is a buy anywhere, return anywhere scheme. A reuse future is where businesses that currently profit from a single-use value chain actually profit from reuse, he said.

'We know that we can drive additional, commercial value from reuse, because customer retention rates are higher, engagement rates are higher,' Chidley said.

He also had this surprising ask, 'Can we stop collaborating please?' highlighting that, 'If the discussion does not get followed by action, you have failed. Collective action is the word that has to replace collaboration.'

Conway firmly espoused that, 'Reuse in general is a huge opportunity for economic growth. And I think everyone is seeing it as this threat'. She would much rather people who work at Materials Recycling Facilities worked at a hygienic washing plant instead.

And with Packaging Extended Producer Responsibility costs in train, 'I truly believe that reuse will be the driver, not only to help deliver sustainability targets, but as well to decrease the financial burden on companies, on all of us,' reflected Fernandez.

'However, if we think about the definition of reuse, refill at the moment, according to the Department for Environment, Food and Rural Affairs, [it] is that packaging that has been designed to be refilled or reused at least once? That’s a bit vague, so does it mean that I can put it twice in the market and then, dispose of it, then, hey, that’s reusable, refillable? Not quite sure.'

Conway would love to see a reuse association to represent the organisations attempting this.

Going back to the bottom line, Chidley felt the onus to be on 'diverting marketing dollars or pounds from single-use marketing into driving reuse. If we can prove that we can drive commercial value for every pound that’s spent on advertising reuse gives a greater return, that is the big unlock, because marketing budgets are the biggest in a lot of organisations'.

Harnessing the Global South’s experience in reuse

The Reuse in the Global South report from the Ellen MacArthur Foundation estimates that moving to a reuse model can reduce annual plastic leakage to the ocean by more than 20%, while significantly reducing virgin material use, greenhouse gas emissions and water consumption.

The report, co-authored with WWF, shares that, although Indonesia, the Philippines and India are the fastest-developing, flexible-packaging markets, the Global South regions have long practiced successful reuse solutions well before they were considered sustainable, such as India’s renowned ‘dabbawalla’ lunch delivery service. While the Filipino tingi culture of buying goods in small, affordable quantities originated with refilling reusable containers – such as bags or baskets – at local markets.

The report suggests these established reuse systems could accelerate the transition to a circular economy, and showcases case studies that demonstrate the economic, social and environmental benefits of reuse systems.

The report notes that 'such strong foundational elements have given rise to a recent history of alternative delivery systems to support the expansion of formal reuse models. For instance, Asia Pacific makes up 35% of the global market for returnable glass bottles'.

The publication explores the possibilities and challenges for building on these foundations, and notes it requires businesses, policymakers and the informal sector to collaborate 'for reuse to thrive at scale'. It identifies a lack of guidelines and standards to ensure consistency across value chains.

It emphasises that the reuse market is a multibillion-dollar economic opportunity, with scope for the informal sector, and micro-, small- and medium-sized enterprises to improve reuse logistics while supporting livelihoods.

The authors particularly cite the Global Plastics Treaty as a crucial opportunity to accelerate the transition from single-use to reusable products and systems.

Meanwhile at the Global Reuse Summit earlier this year in Bristol, UK, a panel on the ‘Global leaders of the Reuse Revolution’ discussed the challenges and opportunities of implementing reuse in the Global South and beyond.

Eline Leising, Head of Zero Waste Living Lab for Enviu in Indonesia, talked about how their reuse systems have proven to work, even for low-income groups, but unfortunately single-use plastic packaging has become a 'super-optimised system that is everywhere'.

'If we want to really scale this up, we need innovators, policymakers, brands to collectively say ‘this is what we are going to do, we are going to actually invest in the reusable system. It can work and we’ve proven that – also the financials can work, you can make revenue from this.'

Célia Rennesson, Co-founder and Director of Réseau Vrac & Réemploi, a national reuse network in France, explained how the country’s Extended Producer Responsibility scheme only includes a target of 10% of reusable packaging by 2027, so still bolstering single-use models.

She described the scale of the challenge. 'We are talking about changing the supply chains, changing all the production lines, and this really requires a lot of money and a lot of investment fees.'

She shared the ongoing battle to explain that reuse is not recycling and comes first in the waste hierarchy. '[We need] a set of rules that are global and that are different from the current one otherwise reuse will never be profitable or ever be able to scale.'