If I had a nickel…

How reducing nickel demand in stainless steel could promote its availability for batteries.

Nickel is a critical or strategic material with rapidly growing demand, prominently driven by the growth in demand for lithium-ion batteries (LIB) for electric vehicles (EVs).

We have a huge opportunity to enable the energy transition and save money. If we reduce primary nickel use in stainless steels (STS), we promote the steel’s cost-effective use, influence the price and availability of nickel for batteries, and decrease CO₂e emissions.

In 2024, 65% of the 3.5Mt of primary nickel production was still used to make STS. In 2023 and 2024, there was a surplus in primary nickel supply over demand, resulting in the London Metal Exchange (LME) price settling at around US$15K/t-$16K/t in 2025 and the closure of some high-cost mines.

Did you know?

Shortages of nickel drove the London Metal Exchange price to rise as high as US$50K/t in 2007.

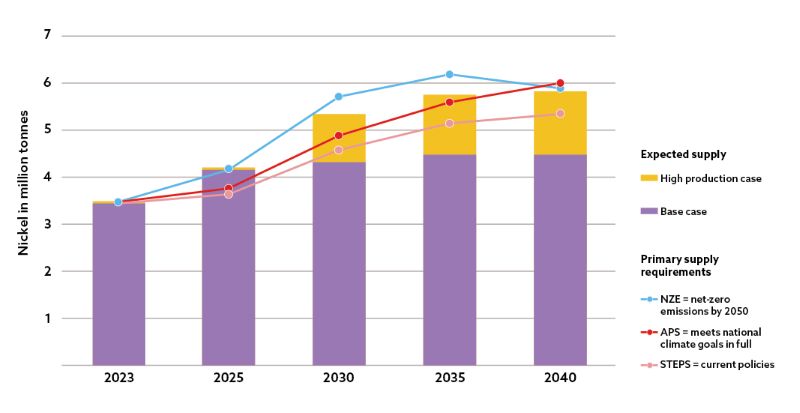

However, projected increasing demand is expected to lead to a shortfall of supply, despite the development of large mining and extraction projects. Both the International Energy Agency (IEA) – see image below – and the Energy Transition Commission (ETC) project supply and demand over the next few years.

The ETC Report, Material and Resource Requirements for the Energy Transition considered various aspects of future demand and supply for nickel.

On the supply side, they estimate a 2025 supply capacity of 4.4Mt, which presumably includes mothballed high-cost mines, since it is substantially in excess of 2024 production of 3.5Mt. The ETC supply forecast of 4.9Mt for 2030 shows little overall growth, implying that additional low-cost Sino-Indonesian projects will merely replace closed, high-cost facilities elsewhere.

In its demand forecasts, the ETC consider a number of factors, including the growth in manufacturing of EVs; trends in size/power/range of EVs; innovations in battery type and construction affecting the nickel use per unit of power; EV lifespan and the timescale/efficiency of recycling of battery contents; and nickel use in other energy transition applications (electrolysers and wind turbines). They also consider a range of scenarios from ‘baseline decarbonisation’ to ‘maximum efficiency and recycling’ through to 2050.

The ETC concludes that, from 2030 onwards, there is a significant risk that the energy transition may be constrained by insufficient nickel supply.

Both studies show a need to invest 10s of billions of dollars in new primary production of nickel, and also in plants for recycling LIBs to produce secondary nickel and other metals.

Both studies also consider evolving battery technologies to mitigate shortages and high nickel prices. Manufacturers may select nickel-free LIB designs, which generally have lower energy density. This reduces EV range making them less attractive, as does, conversely, the higher EV price due to high nickel price.

However, I think that both these studies may be underestimating the future demand for primary nickel for STS and other alloys.

Staying ahead of the curve

The much lower IEA projections for nickel in alloys is based on the expectation of greatly increased recycling of STS in China and other Asian countries, and also of lower growth in STS production.

Sources focused on the STS industry predict robust continuing growth in melt-shop tonnage at compound annual growth rates (CAGR) ranging from 1-5%.

Therefore, if we assume a constant rate of primary nickel content (around 4%) and a CAGR of 5%, we will need 4.1Mt of primary nickel to make 100Mt of STS in 2035, 5.2Mt of primary nickel in 2040 and 8.5Mt in 2050.

The global percentage of nickel in STS is affected by both the mix of STS grades produced and the incorporation of nickel-bearing scrap.

The original 300 Series austenitic STS contained 18% chromium for corrosion resistance, and 8-12% nickel to stabilise the austenitic structure, which gave desirable mechanical properties. Now we have hundreds of grades of STS.

The World Stainless Association highlights 400 Series STS with enhanced corrosion resistance is available, which can replace the 300 Series STS in most environments at ambient temperatures.

The 400 Series ferritic STS typically has less than 1% nickel. Volatility in the nickel price has driven companies like IKEA to make a sustained effort to change from 300 to the 400 Series STS for applications in benign household environments.

Where the mechanical characteristics of austenitic STS are required, 200 Series STS containing 3-6% nickel are available. These contain enough manganese and nitrogen to stabilise the austenitic structure.

In China and other Asian countries, where STS production is growing fastest, 400 Series and 200 Series are preferred, but incorporation of recycled scrap is at a low rate because the material in service is not old enough to generate scrap. In Europe and North America, 300 Series STS continues to predominate, and the scrap incorporation rate is high, although it is a mix of STS and mild steels.

The preference for 300 Series STS appears to be an example of market inertia due to consumer expectations, embedded specifications and part drawings, scrap availability and supply chain stocking practices.

I propose that we coordinate global action to apply best practice in selecting STS grades and process routes using the least primary nickel, with the goal of 3% primary nickel in global STS by 2035 and 2% by 2045. That would reduce primary nickel consumption by 1Mt/year, close the supply gap and enable cost-effective LIB production.

Consider some crude arithmetic, assuming primary nickel consumption for clean-energy applications is ~2Mt/year in 2035.

Scenario A – Business as usual in STS melting; nickel supply shortage; high price for nickel.

- Primary nickel at 4% in STS = 4Mt

- Primary nickel in LIB for EVs = 2Mt

- Market price of primary nickel = US$30,000/t

- Total cost of primary nickel in STS + EVs = US$180bln

Scenario B – Reduced nickel in STS; nickel supply covers demand; lower price for nickel.

- Primary nickel at 3% in STS = 3Mt (for 100Mt STS)

- Primary nickel in LIBs for EVs = 2Mt

- Market price of primary nickel = US$15,000/t

- Total cost of primary nickel in STS + EVs = US$75Bln

- The difference between the scenarios is US$105bln/year and 45Mt of CO₂e, plus CO₂e savings from recycled steelmaking.

It may well be that ‘the unseen hand of the market’ will move us part way from A to B, but there will be volatility, time lags, missed opportunities and undesirable side-effects. How can we coordinate purposeful action in a market with dozens of producers and millions of consumers and supply chain intermediaries?

Did you know?

If the global production of stainless steels continues to grow at a compound annual growth rate of ~5%, that implies a 2035 production rate of ~100Mt/y. If we continue with 4% primary nickel content, that requires ~4Mt/y of primary nickel.Did you know?

If we reduce global stainless steel to 3% primary nickel by 2035, that would reduce primary nickel consumption by 1Mt/y, close the supply gap and enable cost-effective lithium-ion battery production.Did you know?

Ferronickel production emits about 45kg of CO₂e per kg of contained nickel. Compare that to ~2kg CO₂e per kg of mild steel, ~4kg CO₂e per kg of copper, and ~20kg CO₂e per kg aluminium.

Source: Understand Your Nickel Emissions, Carbon Chain

Alloying together

Various EU initiatives offer a way forward. A key element seems to be the European Commission’s Emissions Trading Scheme (ETS) and Carbon Border Adjustment Mechanism (CBAM), and the equivalent UK schemes.

The ETS/CBAM is the EU’s landmark tool to put a fair price on the greenhouse gases (GHG) emitted during the manufacture of certain GHG-intensive goods, including iron and steel, in the EU (ETS) or entering the EU (CBAM).

The EU’s CBAM aims to ensure that its climate objectives are not undermined and encourage cleaner industrial production in non-EU countries. Since 2023, the EU CBAM applies in its transitional phase.

Note the distinction between Scope 1 emissions, which are from sources that a company owns or operates directly; Scope 2 emissions, which come from the sources of energy that a company purchases; and Scope 3 emissions, which are not directly from the company’s activities, but from those activities up and down the value chain it is responsible for – such as, in the manufacture of purchased components or raw materials.

The European Commission’s Steel and Metal Plan refers to a 2025 review of CBAM Regulations. I propose that this review should prioritise critical minerals and apply CBAM to each of them in an appropriate manner.

The import of ferronickel and nickel pig iron (NPI) as precursors for steel manufacture is already subject to the EU CBAM Regulations on Scope 1 and Scope 2 emissions. Although in 2026, CBAM credits will only need to cover 2.5% of emissions, rising to 100% in 2034 as free-issued credits in the ETS scheme are phased out.

If I understand correctly, the import of STS will not be subject to CBAM credits on Scope 3 emissions, so the use of carbon-intensive NPI will not be penalised. This seems like a big hole.

The CO2 emissions in making the NPI are much greater than the CO2 emissions from making the STS. If steels containing less than 95% iron were subject to CBAM on 100% of Scope 1, 2 and 3 emissions from 2026, there would be a strong incentive to select low-nickel grades. There would be a direct link to the value of green nickel (a controversial subject for the LME) and some protection for European/UK stainless steelmakers who have invested in green steel.

The European Steel and Metals Plan describes further relevant initiatives. To enable the industries investing in decarbonisation to reap the ‘green premium’, the Industrial Decarbonisation Accelerator Act will develop a voluntary label on the carbon intensity of industrial products, based on ETS data and CBAM methodology.

Also, the Ecodesign for Sustainable Product Regulation will compliment that label by developing requirements for products with high-steel content and add relevant environmental criteria beyond the carbon footprint. It would be very useful if that included the primary nickel content of steel in the labelling.

Finally, self-interest. The only ‘sure things’ in the future nickel market are uncertainty and volatility in price and availability.

If you are designing with STS or working in an STS supply chain, reduce cost by finding a way to make it work with a lower nickel grade of STS. You will also protect your project/company by minimising exposure to nickel.