Heavyside mineral products broke records in 2021

Delivered volumes of heavyside mineral products broke records in the second quarter of 2021 pointing to robust construction and manufacturing activity despite reports of material and staff shortages.

The latest quarterly survey from the Mineral Products Association (MPA) shows that in recent months the industry has supplied the highest quarterly volumes of materials such as aggregates and asphalt in more than 12 years.

This contrasts with ONS data suggesting that construction output slowed in April and May. As heavyside materials tend to be used early in building projects – for foundations and core structures – the MPA figures suggest that construction will remain buoyant for at least the next few months.

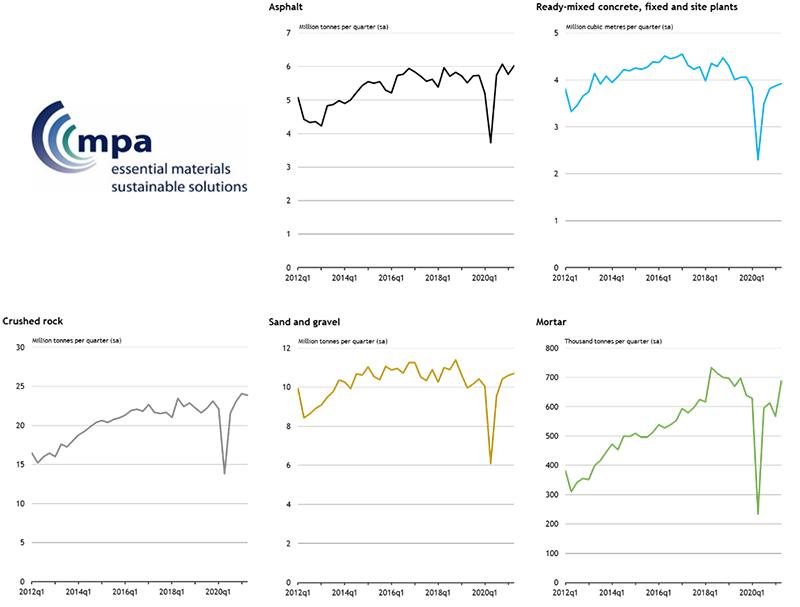

For aggregates, although sales of primary crushed rock, sand and gravel recorded a small decline of 0.4% in 2021 Q2 compared to Q1, the first half of 2021 saw aggregates sales volumes at their highest since mid-2008. Aggregates sales have recovered rapidly in the past year, boosted by demand for bulk fill materials on major infrastructure projects and highway schemes.

Asphalt sales volumes rose by 4.5% on a quarterly basis in 2021 Q2 to over 6 million tonnes, the second highest volume recorded since 2008 (the highest was in 2020 Q4). Pent-up demand from delayed roads projects due to the pandemic, wider progress on the delivery of Government’s road investment strategy, and an increase in demand from local authorities for repair and maintenance work, all resulted in an unexpectedly rapid recovery in activity. Total demand for asphalt in the year to June 2021 was 4.0% higher than in 2019, with demand particularly strong in Scotland and the East Midlands.

In mortar sales, which closely reflects housebuilding activity, volumes rose at their second fastest quarterly rate of growth since 2012, up by 21.2%, although some of that is likely to be a ‘catch-up’ from the impact of adverse weather at the start of the year. Growing momentum in mortar sales is evidence of new housebuilding activity starting, rather than the completion of existing developments. This indicates a renewed pipeline of work for other sectors of the construction supply chain over the next few months.

By contrast, market conditions for ready-mixed concrete remain weak. Concrete sales volumes increased by 1.2% from Q1 to Q2 but a comparatively slow recovery since last year means that volumes on an annual basis are significantly down compared to 2019, particularly in London and the South East. Demand from industrial projects is strong, with the building of new distribution centres for online retailers. The biggest driver of activity is infrastructure, especially with work increasing on HS2. On the other hand, demand from office and retail developments is weak as the sector is still coping with the cumulative effects of four years of Brexit-related uncertainty, compounded by the ongoing impact of the pandemic.

MPA anticipates that demand for core construction materials will remain high for the remainder of this year and into 2022. The outlook for construction, and in particular infrastructure, is expected to drive double-digit growth in mineral products sales through 2021 with further, albeit more muted, growth in 2022.