Aggregate economics

Key factors underpinning demand for construction and aggregates include the economic performance of the UK and associated private and public expenditure on construction, changes in population and demographics and the consequences of Government policy.

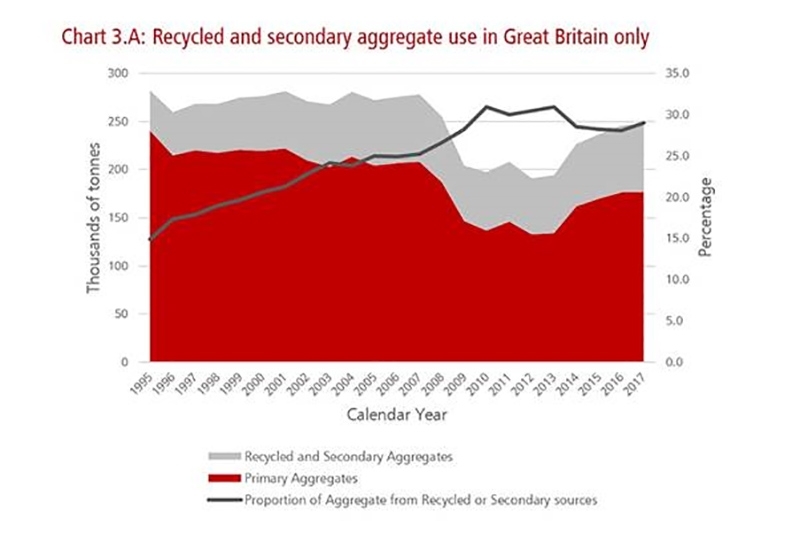

Aggregates are supplied from both primary and recycled and secondary sources. Primary sources include the quarrying of crushed rock and sand and gravel and the dredging of sand and gravel from the seabed. Recycled sources include materials previously used in construction markets such as crushed concrete from demolition waste, road planings and spent rail ballast. Secondary materials are those by-products or co-products from other manufacturing or extractive activities which can be used in aggregates markets, for example slate waste, china clay waste, iron and steel slags and waste glass.

There have been significant changes in the relative contribution of the different sources of supply since data on sales volumes was first collected regularly by Government in the post war period. At that time the predominant source was quarried sand and gravel, but in recent decades the supplies of crushed rock and recycled/secondary materials have become relatively more significant.

The diagram below shows recycled and secondary aggregates use in Great Britain recently. In broad terms the share of recycled and secondary has increased to around 30%.

There is a relatively small level of international trade in aggregates, with imports into and exports from Great Britain generally accounting for no more than 4% of the market.

Given that the research indicates that most significant sources of recycled / secondary materials are already well utilised in GB, this suggests that the amount of material which is available is now the most important factor in the use of these materials. In other words there is a strong established culture in the GB Construction sector to use recycled/secondary materials where possible and strong incentives to do so.

Aggregates market structure - demand

In addition, 15 – 20 million tonnes of aggregates minerals are used annually for non-aggregates purposes, for example silica sand for glass making and limestone for iron and steel and cement manufacture.

Aggregates are used throughout the construction industry, although detailed and consistent data on the use of aggregates by construction sector is not available, the Government's Annual Minerals Raised Inquiry (AMRI) gives some indication of construction uses.

There is, unsurprisingly, a reasonable long-term relationship between the two sets of data although this relationship is not consistent from year to year.

Construction output represents a significant share of national economic activity, typically 7-8%. However, the ONS construction output statistics understate the total contribution of construction due to sector statistical definitions, for example not including all professional services associated with construction or related transport movements. As a result, the construction contribution to Gross Domestic Product is at least 10%. The aggregates and associated sectors account for some 5% of construction output and represent by far the largest flow of materials into construction.

Factors influencing future aggregates markets

Key factors underpinning future demand for construction and aggregates include the economic performance of the UK and associated private and public expenditure on construction, changes in population and demographics and the consequences of Government policy objectives which are likely to focus increasingly on sustainable development and countering climate change.

Taxation and regulatory impacts

Regulatory and taxation costs in the aggregates sector have increased significantly in recent years. The most direct cost is the Aggregates Levy, introduced in April 2002 and reviewed in 2020.

There has also been a general trend of increasing regulatory costs in the sector as Government and regulatory bodies have increased a range of planning, monitoring and enforcement charges imposed on companies. Due to the pressures on the UK’s public finances, such costs are unlikely to diminish.