Welcome to Clay Technology, the member magazine of the International Clay Technology Association.

The magazine is available thrice yearly and features are visible to members once logged in.

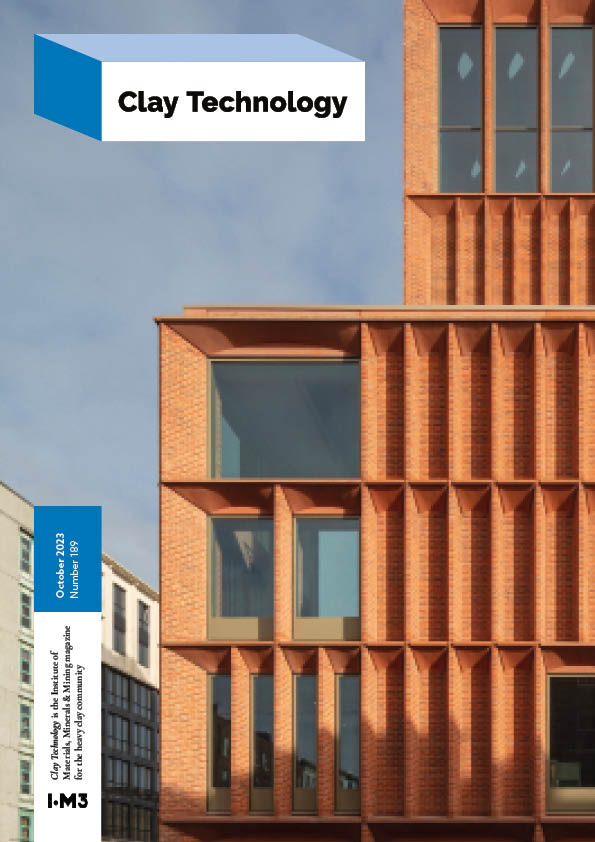

'The humble handmade brick has become an integral part of the visitor experience,' reflects Tom McGlynn from Niall McLaughlin Architects in his article about the ‘Cathedral to Rugby’ in Limerick, Ireland.

A similar ode to brick's enduring appeal is in the restoration of the Crystal Palace Subway in London, UK. David Pope of brickwork consultant Ernest Barnes describes the 'philosophy for the repairs', where new bricks are inserted next to historic ones.

We hope you enjoy this issue.